Tinubu Insists on January 2026 Commencement of New Tax Laws

By Patience Ikpeme

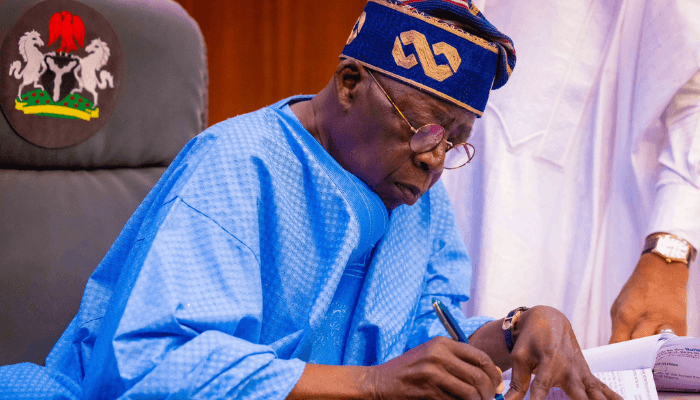

President Bola Ahmed Tinubu has declared that the implementation of the nation’s new tax regime will proceed as scheduled, dismissing calls for a delay or disruption of the reform process.

The President maintained that the legislative framework, including the laws that came into effect on June 26, 2025, and those set for January 1, 2026, represents a critical turning point for the country’s economy.

In a statement released on Tuesday, the President described the ongoing overhaul as a “once-in-a-generation opportunity” aimed at establishing a fiscal foundation that is competitive, fair, and robust.

He sought to clarify the intent behind the legislative changes, noting that the primary goal is not to impose a heavier burden on citizens but to achieve a necessary systemic shift.

“The tax laws are not designed to raise taxes, but rather to support a structural reset, drive harmonisation, and protect dignity while strengthening the social contract,” President Tinubu said.

The President addressed recent public debates and concerns regarding specific sections of the enacted laws. While acknowledging the ongoing discourse, he insisted that the findings do not justify pausing the current momentum. He stated that “no substantial issue has been established that warrants a disruption of the reform process,” adding that “absolute trust is built over time through making the right decisions, not through premature, reactive measures.”

With the reforms now moving into what the administration calls the “delivery stage,” the President called upon all stakeholders to cooperate with the government during this transition. He assured the public that the executive arm remains dedicated to following due process and maintaining the legal integrity of the new statutes.

“I emphasize our administration’s unwavering commitment to due process and the integrity of enacted laws,” the President stated. He further pledged that the Presidency would “work with the National Assembly to ensure the swift resolution of any issue identified.”

The suite of laws seeks to consolidate several decades of fragmented tax legislation. The reform aims to simplify compliance for businesses and create a more investor-friendly environment by modernizing corporate tax structures and streamlining revenue collection.

President Tinubu concluded by reassuring the citizenry that the government’s actions are guided by the “overriding public interest.” He noted that the ultimate goal remains a tax system that “supports prosperity and shared responsibility” for all Nigerians.