Nigeria Commits to We-Fi Code for Women Entrepreneurs

By Patience Ikpeme

Nigeria has taken a significant step towards improving financial access for women-owned businesses by joining 23 other countries in adopting the Women Entrepreneurs Finance (We-Fi) Code.

This commitment was formalized during the Declaration of Commitment to the We-Fi Code in Abuja on Wednesday, signaling Nigeria’s dedication to unlocking the economic potential of women entrepreneurs.

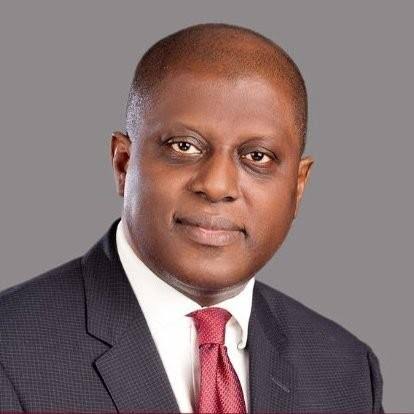

Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, led the initiative, emphasizing the importance of developing policies and financial products that cater to the needs of women-owned and women-led micro, small, and medium enterprises (MSMEs).

The declaration was supported by key financial institutions, including the Bank of Industry (BoI) and the Development Bank of Nigeria (DBN), all of which publicly declared their commitment to the We-Fi Code.

The We-Fi Code is a comprehensive framework aimed at increasing access to finance for women-owned MSMEs. It brings together regulators, development finance institutions, financial service providers, and other key stakeholders in the financial ecosystem to create a more inclusive and supportive environment for women entrepreneurs.

According to CBN Governor Cardoso, “This initiative presents a tremendous opportunity to unlock the economic potential of women entrepreneurs across our nation, helping them to expand their businesses and contribute to the overall economic growth of the country.”

Cardoso explained that despite various initiatives, women remain one of the most financially excluded segments of the population, as identified in Nigeria’s National Financial Inclusion Strategy (NFIS3). Alongside women, youth, rural communities, MSMEs, and northern Nigeria were flagged as the groups most underserved by financial services.

“We are committing to leading by example and urging all stakeholders in the financial ecosystem to adopt the We-Fi Code as part of our collective drive to enhance the financial inclusion of women entrepreneurs in Nigeria,” Cardoso added.

The Central Bank of Nigeria’s Financial Inclusion Delivery Unit will serve as the coordinator for the implementation of the We-Fi Code, with a mandate to monitor its impact on women’s financial inclusion and to integrate it into the broader National Financial Inclusion Strategy. Cardoso noted that the national commitment to the We-Fi Code is a powerful step towards empowering women entrepreneurs as key contributors to Nigeria’s economic and social development.

Dr. Tony Okpanachi, Managing Director of the Development Bank of Nigeria (DBN), reaffirmed the bank’s strong support for the We-Fi Code and its alignment with the DBN’s ongoing initiatives. Okpanachi highlighted that DBN has already disbursed over ₦187 billion through its Participating Finance Institutions (PFIs) to more than 357,000 women-owned businesses, which now account for 72% of DBN’s beneficiaries.

“This reflects our unwavering commitment to empowering female entrepreneurs across the nation,” Okpanachi stated. He also pledged that DBN would designate a senior leader within the organization to oversee the implementation of the We-Fi Code and ensure that women entrepreneurs gain access to both financial and non-financial resources crucial for their growth.

DBN’s commitment extends beyond financing, with Okpanachi promising to align the bank’s reporting standards with those of the We-Fi Code. The bank will track and report on indicators related to financing women-led MSMEs, ensuring transparency and accountability in its efforts to support gender-inclusive financing.

Dr. Olasupo Olusi, Managing Director of the Bank of Industry (BoI), added that the We-Fi Code represents a decisive move to dismantle the financial barriers faced by women entrepreneurs in Nigeria. By leveraging data and uniting stakeholders across the financial ecosystem, the initiative aims to ensure a more equitable distribution of financial resources.

Olusi explained that the BoI is committed to aligning the We-Fi Code with Nigeria’s broader National Financial Inclusion Strategy, reinforcing the bank’s goal of closing the gender gap in access to finance. “Through the We-Fi Code, we are taking decisive steps to ensure that women entrepreneurs no longer face the obstacles they once did when seeking financial support,” he remarked.