CBN, WAIFEM Warn Nigeria, Others of New Debt Risks

By Patience Ikpeme

The Central Bank of Nigeria (CBN) and the West African Institute for Financial and Economic Management (WAIFEM) have issued warnings pertaining to how West African countries, including Nigeria, are managing their debt.

Traditionally, countries often borrowed from the Paris Club, a group of creditor nations. However, both the CBN and WAIFEM highlight a significant shift towards borrowing from non-Paris Club members and private lenders, like banks and investors.

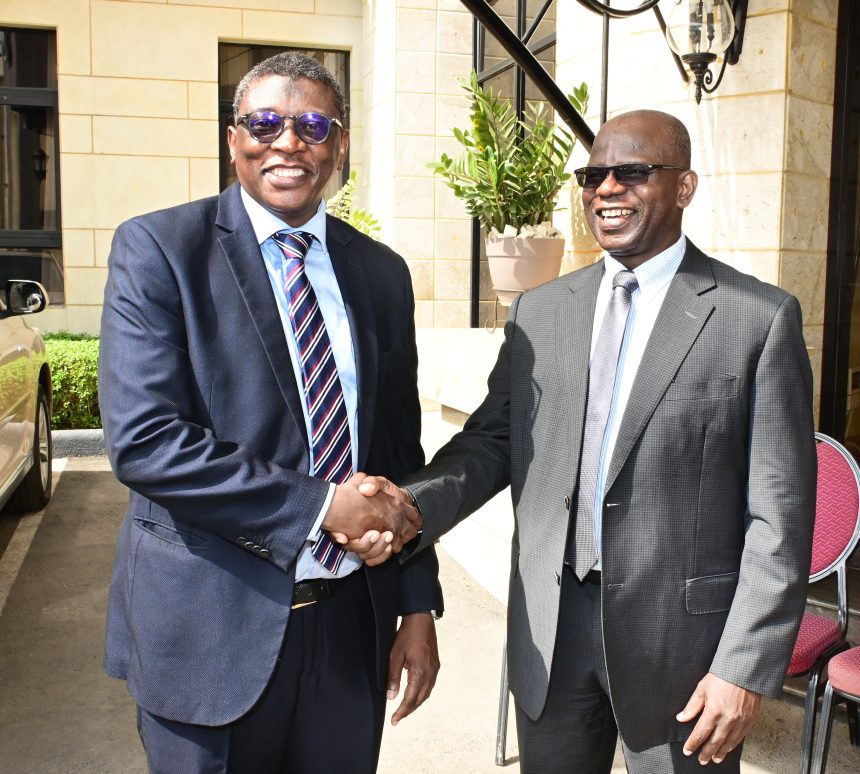

While this change might seem minor, the CBN Governor, Mr. Yemi Cardoso (represented by Dr. Mohammed Musa Tumala, Director Monetary Policy Department of the CBN), cautioned that the trend is a critical development with potential risks.

“The way countries manage debt owed to the Paris Club may not be as effective for these new lenders, who might have stricter repayment terms and potentially higher risks” Cardoso warned.

Recent events like the COVID-19 pandemic and global conflicts he noted have further strained finances, making countries more likely to seek loans from diverse sources.

While Nigeria’s overall debt risk is currently classified as moderate, the CBN urges caution, particularly regarding potential liquidity risks. This risk stems from weak revenue generation, a persistent challenge hindering debt sustainability and economic stability.

Dr. Baba Yusuf Musa, Director General of WAIFEM, emphasized that while Nigeria has room to borrow based on its debt-to-GDP ratio, the real concern lies in its ability to repay those loans using revenue.