CBN Governor: Bank Recapitalization Is “Making Good Progress”

By Patience Ikpeme

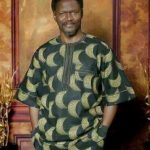

The Governor of the Central Bank of Nigeria (CBN), Mr. Olayemi Cardoso, has announced that the ongoing bank recapitalization exercise is “making good progress” and is set to create stronger financial institutions capable of withstanding economic shocks and financing growth.

Speaking at the European Business Chamber (Eurocham Nigeria) C-Level Forum, Cardoso said the exercise will lead to banks that are more resilient and able to support the country’s economic goals.

Cardoso told the audience that the CBN is committed to achieving macroeconomic stability, strengthening the banking sector, and positioning Nigeria as a top investment destination.

He said that the central bank’s reforms and the stabilization of the naira have led to renewed investor confidence, a sentiment shared by members of the EU Chambers present at the event.

While acknowledging that headline inflation remains high, Cardoso said it is decreasing due to collective efforts and that the benefits of the central bank’s tightening monetary policy are expected to continue. “We will protect the stability that has been re-established in the financial system with the utmost zeal,” he stated. “Our primary objective is to maintain that stability while simultaneously addressing inflation and ensuring that the financial system is sufficiently resilient to facilitate corporate lending and investment.”

When asked about the effect of high lending rates on investment, the Governor linked the issue to the current inflation rate. He said there is a substantial potential for interest rates to decrease as inflation continues to fall and as markets become more efficient in allocating capital. “That is the environment in which stronger corporate lending and higher levels of investment will naturally follow,” he explained.

Cardoso explained that the CBN’s recapitalization directive, which requires banks to increase their minimum capital, is specifically aimed at strengthening the financial system to support a wider range of economic activities. He also mentioned the importance of technology-driven solutions to deepen financial inclusion and address poverty, as well as efforts to strengthen the fintech ecosystem.

The governor also identified a positive development in the form of increased collaboration with the fiscal authorities, including the Ministry of Finance, the Ministry of Trade and Industry, and the Budget Office. He said this partnership is crucial for sustaining reforms and achieving long-term stability.

In his remarks about Nigeria’s place in the global economy, Cardoso said that recent geopolitical changes underscore the urgency of addressing domestic affairs. “Nigeria is a market that is both large and appealing in its own right, and it is also situated at the entrance to the broader continent and West Africa,” he said. “This underscores the importance of maintaining stability at home.”

The President of Eurocham, Yann Gilbert, who moderated the forum, said the chamber serves as a link between European businesses and Nigerian policymakers. “Our members are profoundly dedicated to this nation,” he said. “We aspire to establish enduring partnerships, generate employment opportunities, and invest.”