African Nations Rally for a Groundbreaking Convention on International Tax Cooperation

By Patience Ikpeme

A coalition of African nations has come together to advocate for the adoption of a groundbreaking Framework Convention on International Tax Cooperation. Spearheaded by the African Group, this initiative aims to address the historical imbalance in global tax governance and provide developing countries with a stronger voice in shaping international tax norms.

The African Group, in a press release issued at the United Nations in New York, expressed disappointment in the current global tax system, which was predominantly crafted by developed nations. This system has long been criticized for its failure to tackle the unique challenges faced by developing countries, particularly in collecting taxes from multinational corporations (MNCs) that shift their profits away from these nations.

This profit shifting deprives developing countries of vital revenue, hindering their ability to invest in crucial sectors such as healthcare and education. The proposed Framework Convention on International Tax Cooperation seeks to rectify these imbalances by establishing a more equitable and inclusive tax system.

This convention would serve as a platform for all nations, regardless of their size or economic power, to participate in shaping international tax rules. By ensuring that developing countries have a seat at the table, the convention aims to prevent the imposition of tax rules that disproportionately disadvantage these nations.

Prof. Bolaji Owasanoye, the outgoing Chairman of the Independent Corrupt Practices and Other Related Commission (ICPC) of Nigeria, expressed Nigeria’s strong support for the proposed framework convention. He emphasized the urgent need to address the inequities in the current tax system, which have prevented Nigeria and other developing countries from receiving a fair share of MNCs’ revenue.

Prof. Owasanoye urged developed nations to soften their resistance to a UN-driven multilateral tax convention, acknowledging that such a convention is crucial for achieving sustainable development on a global scale, and ultimately realizing a world where no country is economically dependent on another.

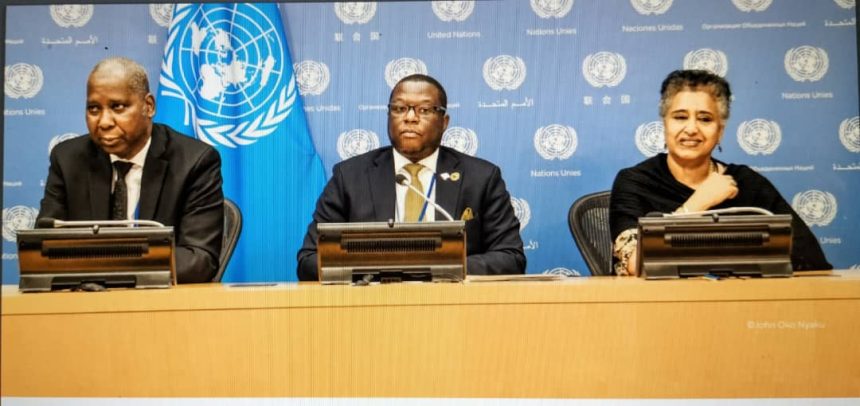

H.E. Dr. Chola Milambo, the Permanent Representative of the Republic of Zambia to the United Nations, leads the African Group and highlights the potential of this framework convention to unlock greater revenue for developing countries. This increased revenue could be directed toward critical investments in healthcare, education, and other essential sectors, fostering sustainable growth and development across Africa and the Global South.

Beyond its economic benefits, the proposed convention is seen as a vital step toward reducing dependency on international aid. By enabling developing countries to generate more revenue domestically, the convention could empower these nations to finance their own development priorities, thereby fostering a more self-reliant and resilient world economy.

While recognizing the importance of cooperation with developed nations, the African Group urges its partners, including the Organization for Economic Cooperation and Development (OECD), the European Union, the United States, and the United Kingdom, to embrace the proposed framework convention. They stress that this convention is not merely a fiscal tool but a lifeline for the millions of individuals who aspire to better healthcare, education, and a life of dignity.

The proposed Framework Convention on International Tax Cooperation represents a critical step toward achieving a more just and equitable global tax system. By ensuring that all nations have a voice in shaping international tax rules, the convention has the potential to unlock greater revenue for developing countries, reduce their reliance on international aid, and foster sustainable growth and development across the globe.