Stronger Laws Now Empower NDIC to Prosecute Bank Failure Culprits

By Patience Ikpeme

The Nigeria Deposit Insurance Corporation (NDIC) is now equipped with stronger and more effective legal powers to prosecute parties responsible for bank failures, marking a significant milestone in the nation’s financial regulatory framework.

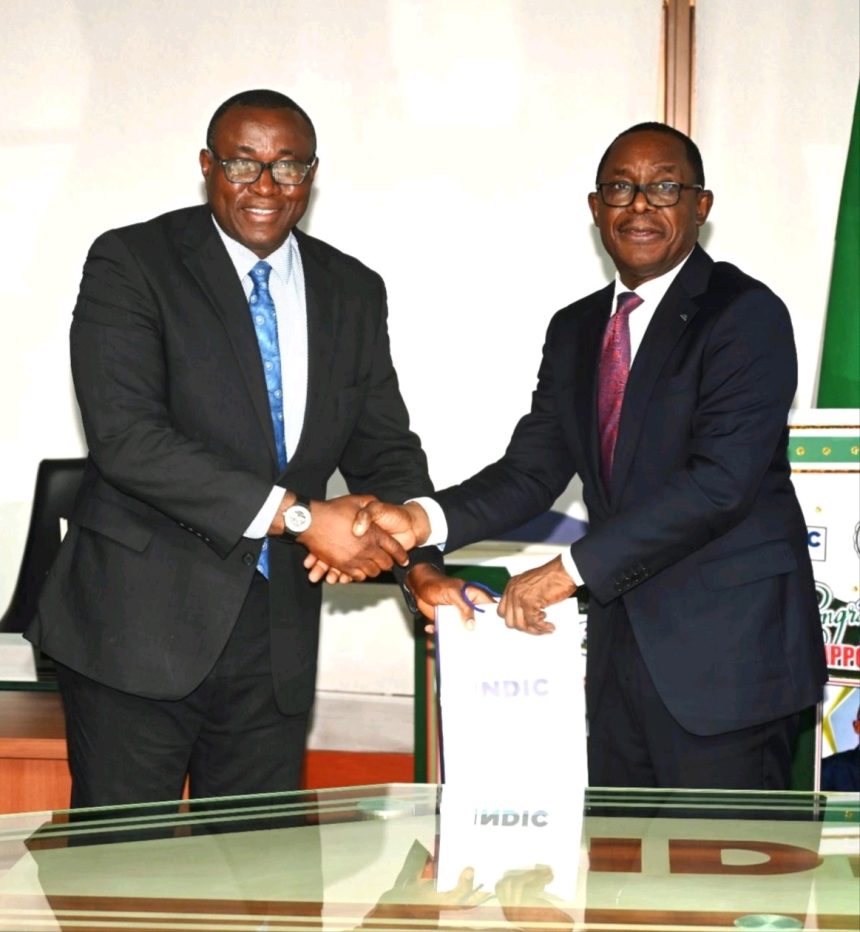

Mr. Thompson Oludare Sunday, Managing Director and CEO of NDIC, revealed this development during a courtesy visit from the President/Chairman of Council of the Business Recovery and Insolvency Practitioners Association of Nigeria (BRIPAN), Mr. Chimezie Victor Ihekweazu (SAN), and his team at the NDIC Headquarters in Abuja.

“Our powers in liquidating failed insured institutions have been significantly enhanced with the NDIC Act No. 30 of 2023 and the Banks and Other Financial Institutions Act (BOFIA) 2020,” Mr. Sunday stated. He added, “The enhanced powers granted to the Corporation, together with an improved judiciary understanding, have made it impossible for individuals to hide under the law to escape liability.”

The NDIC boss expressed gratitude to the National Assembly for strengthening the legal framework that had long constrained the Corporation’s operations. He also praised the judiciary for its expertise in deposit insurance law, noting that effective court judgments have provided relief to depositors of failed banks.

Mr. Sunday attributed the Corporation’s ability to realise and distribute liquidation dividends to the uninsured depositors of Heritage Bank Limited within one year to these stronger laws. “With this legal backing, individuals now approach the Corporation to settle out of court, recognizing that the noose is tightening around those responsible for bank failures,” he explained.

Mr. Ihekweazu of BRIPAN highlighted the association’s success in harmonising insolvency-related laws into a unified framework that addresses past challenges and introduces better options for solvency resolution. He also emphasized the need for continued collaboration between BRIPAN, NDIC, and other stakeholders to strengthen insolvency and business recovery practices in Nigeria.

“Our focus remains on capacity building and closer collaboration to ensure the effective discharge of our mandates,” said Mr. Ihekweazu, calling for united efforts to improve Nigeria’s financial stability landscape.

This renewed legal framework and collaborative spirit signal a more robust approach to safeguarding the Nigerian banking system and protecting depositors.