CIoD Applauds NDIC’s Role in Bank Liquidation

…Commits to Stronger Governance Partnership

By Patience Ikpeme

The Chartered Institute of Directors (CIoD) Nigeria has commended the Nigeria Deposit Insurance Corporation (NDIC) for its consistent achievements in the liquidation and resolution of failed banks, noting its significant contributions to the stability of the Nigerian financial system.

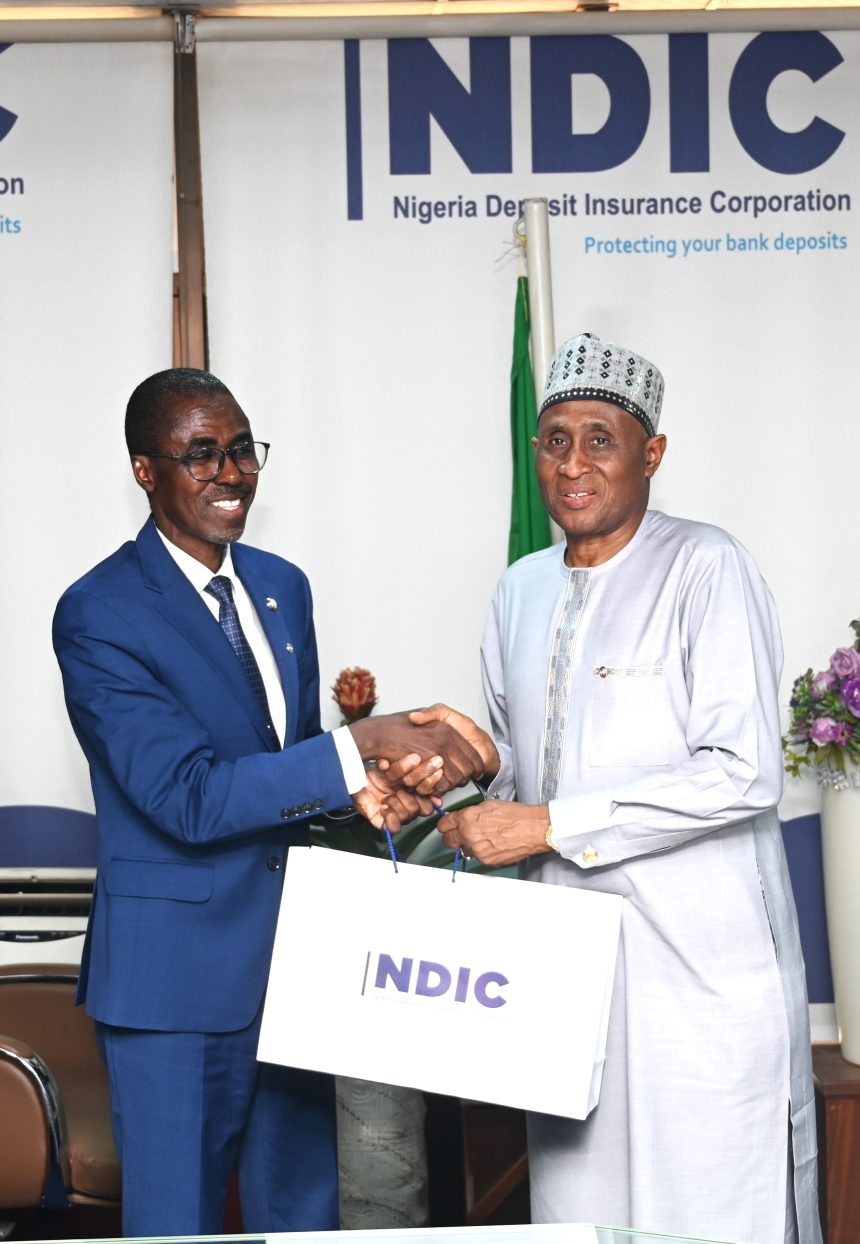

During a courtesy visit to the NDIC headquarters in Abuja, President and Chairman of Council of the CIoD, Alhaji Tijjani Borodo, lauded the Corporation’s track record in implementing its core mandate, particularly in banking supervision and depositor protection.

According to Borodo, NDIC’s operational efficiency, ethical leadership, and sound corporate governance have been instrumental in safeguarding the financial system and protecting depositors’ interests.

He pointed out that weak corporate governance has been a major factor in the collapse of banks in the past. To address this, he said the CIoD has set up internal mechanisms to sanction directors found guilty of unethical practices, reinforcing the Institute’s resolve to elevate governance standards across all sectors, including banking.

Borodo described the Institute’s visit as a step towards deepening its partnership with the NDIC, particularly in the areas of capacity building and leadership development. He revealed that CIoD is committed to working closely with the NDIC on board induction programmes, governance training, and executive leadership initiatives for directors in both public and private sectors.

According to him, this collaboration will help equip directors with the knowledge and ethical framework required to lead responsibly, thereby fostering improved governance practices nationwide.

In his remarks, the Managing Director and Chief Executive Officer of the NDIC, Mr. Bello Hassan, expressed appreciation for CIoD’s efforts in promoting professionalism and accountability in corporate leadership. He reiterated NDIC’s strong commitment to depositor protection and financial system stability, noting that sound corporate governance is central to the Corporation’s operations.

Mr. Hassan said NDIC remains open to sustained collaboration with the CIoD to build a more resilient financial sector anchored on integrity, transparency, and ethical leadership. He maintained that NDIC’s approach to governance aligns with international standards, as reflected in its 2014 award for ‘Best Deposit Insurance Organisation of the Year’ by the International Association of Deposit Insurers (IADI).

He added that while the Corporation continues to ensure prompt reimbursement of depositors in failed financial institutions, it is also working to improve public awareness and reduce systemic delays in the resolution process. Strengthening corporate governance, he noted, is a necessary step toward achieving these goals.

Founded in 1983, the CIoD is Nigeria’s foremost professional body for directors. It is dedicated to promoting good governance through education, advocacy, and mentoring. The Institute’s programmes focus on integrity, professionalism, accountability, and teamwork—values it believes are essential to building competent and ethical leadership across Nigeria’s public and private sectors.

Both institutions have agreed that continued collaboration will help raise the bar for governance practices in Nigeria’s financial system, ensuring that institutions are better equipped to handle operational challenges, restore public confidence, and contribute to national development.